Article Contents

The Quick Guide to Forming a Limited Liability Company (LLC)

The Tax Cuts and Jobs Act of 2017 have spurred a lot of new discussion about the advantages of “pass-through” tax entities like the limited liability corporation (LLC). You may be wondering if this option is an excellent choice for taking your sole proprietorship or general partnership to the next level. So if you are asking yourself “should I create an LLC?” the following guide gives all the information you will need to make an informed decision on whether to form an LLC. It also provides step-by-step details about how to get your LLC registered.

What is a Limited Liability Corporation (LLC)?

An LLC is a hybrid legal entity, combining the pass-through taxation of sole proprietorships and general partnerships with the liability protection of corporate structures. The state authorizes the business organization.

Establishing an LLC provides business owners with a layer of separation between themselves and the service or product they sell or provide; should the company be sued, the owners’ assets are generally protected.

LLCs have a flexible organizational structure to go along with their flexible tax designation. A single person can own his/her LLC, or there can be several members who each receive percentages of the company’s profit. The LLC can be either member-managed or manager-managed. A member-managed LLC distinguishes between owners, or managers, and members, who may play a more passive role in the day-to-day operation of the company. Manager-managed LLCs are structured and act like traditional corporations.

How does the LLC differ from other business and corporate structures?

The critical difference between the LLC and all other business structures is flexibility. As a hybrid, it has taken good features of both traditional corporate structures and sole proprietorships; LLCs place few restrictions on how the company is managed, which gives businesses the freedom to evolve.

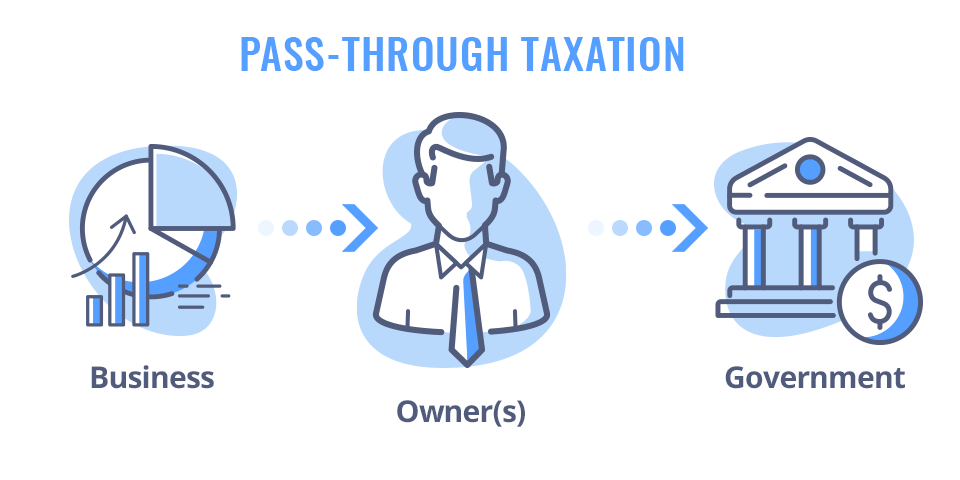

Pass-Through Taxation.

Single-member LLCs differ from C corporations—but are similar to sole proprietorships and S corporations—in that taxes are not paid at the business level—instead, income and loss are reported on the members’ tax return, and any taxes due are paid at the individual level as well.

Limited Liability Protection.

LLCs differ from sole proprietorships and general partnerships in that they treat the company as a separate legal entity, which can be sued directly. This gives LLC members limited liability protection of their personal assets.

Flexible Management

C corporations have a formal top-down structure, where the board of directors oversees major business decisions, and the officers oversee the day-to-day business operations. An LLC, on the other hand, can manage its business structure however the members want, and the main rules are noted in an internal document, the operating agreement. Some LLCs are member-managed, which makes them work more like general partnerships. Other LLCs are manager-managed.

What are the advantages of becoming an LLC?

Limited Liability Protection

An LLC protects most of the member’s assets, restricting liability to the personal interest each person has invested in the company. The signatory on a business loan, for instance, would still be liable to make the payments on that loan. However, members are not liable to pay any monies awarded as the result of a lawsuit filed against the LLC.

Pass-Through Taxation

A single-member LLC has the same tax structure as a sole proprietorship, in which business losses and gains are paid through the member’s personal income tax. This has real advantages for a small business startup since members can use early business losses to offset taxes owed on other income.

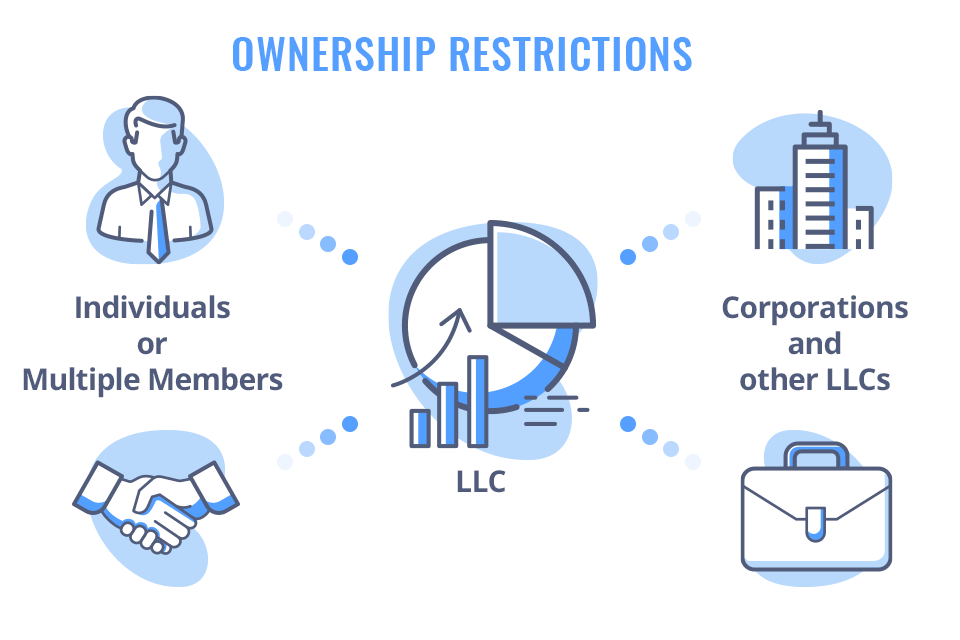

Few Ownership Restrictions

There are no citizenship or residency restrictions on who can become a member of an LLC, nor does a member have to incorporate in the same state where they registered the LLC. States only require that individuals be of the age of majority, 18 in most cases, to register an LLC. That means not only that foreign nationals can become members but also that corporations and other LLCs can become members of an LLC. In some cases, another corporate entity may be the sole member of an LLC. In that event, they would be treated as a partnership or multi-member LLC for tax purposes.

Minimal Compliance Requirements

LLCs have few state-mandated requirements other than an annual filing requirement with minimal accompanying paperwork. All other compliance regulations are subject to the rules determined by the LLCs operating agreement. LLCs can have whatever meetings they wish and document those meeting however they wish, but they are not formally required to hold annual meetings with the board of directors and shareholders.

Flexible Allocation of Profits to Individual Members

The LLC can choose to distribute profits to its individual members based on their ownership percentage. For instance, in a two-member LLC, each one would receive 50 percent of the profits. However, unlike corporations, which must distribute profits that reflect the exact percentage of each shareholder, LLC members can also predetermine a special percentage allocation; if one of the two members contributes more to the company, for instance, he/she might receive 70 percent of the profits.

Versatile tax designation

LLCs have the ability to choose how they are treated as a taxable entity. Although the default established by the IRS is that LLCs be taxed as partnerships, an LLC can elect to be taxed as a C or S corporation whenever its members decide to make the change.

What are the disadvantages of becoming an LLC?

Failure to Delineate Clear Roles

The same flexibility that make LLCs an attractive option—i.e., the relative ease of incorporating and the flexible business management structure—can prove to be a disadvantage if members do not feel the need to delineate roles early on, or fail to anticipate how the company may grow. You can always make changes to an operating agreement. However, in some cases, the default membership rules could give too much power to players who might jeopardize the company’s health by withdrawing their interest too soon or agreeing to a buyout or merger. It is important to have a carefully drafted operating agreement, one that anticipates as much as possible the changes that could take place.

Exceptions to Limited Liability

Businesses that rely on loans for capital during the startup phase could jeopardize LLC members’ personal assets if they cosigned for the debt. For instance, members may have a business loan they obtained by using personal property as collateral. Companies that incur losses before there is appreciation can not only doom a fledgling LLC but also put the individual’s personal assets in jeopardy.

Limits of Pass-Through Taxation

Pass-through taxation is a boon to individuals able to decrease their overall tax burden. However, later on, an LLC member could find themselves paying at higher than the standard corporate rate on pass-through taxes. They will also continue to pay for federal inclusions like Social Security and Medicare.

Need for Careful Records

It is up to the members to decide how the LLC is run. And in order to maintain limited liability, members need to keep business and personal expenses completely separate. Members will also need to maintain a separate business checking account, which can add expense and a layer of complication to the bookkeeping process.

What are the different types of LLCs?

The underlying flexibility of the LLC means that there are many different permutations of this popular business entity.

-

Domestic LLC

This type of LLC was formed, or organized, in the same U.S. state in which it continues to operate.

-

Foreign LLC

A foreign LLC is not “foreign” in the usual sense of the word, meaning that it originated outside the U.S. Rather, a foreign LLC was formed in a different U.S. state from the state in which it operates.

-

Single-Member LLC

This type of LLC has only one owner or member.

Single-member LLCs have only one owner or member. -

Multiple-Member LLC

This type of LLC is like a general partnership, with two or more individuals in charge of the day-to-day operations of the company. A multiple-member LLC needs to spell out the rights and responsibilities of different members carefully in the operating agreement to protect itself from changes that could be harmful to the company.

-

Member-Managed LLC

The more common type of LLC, this is a company in which all the members operate the business themselves, as equal partners.

-

Manager-Managed LLC

The manager-managed LLC differentiates between managers, who have an active interest in the company, and passive members. It is a way for the LLC to give more power and responsibility to some members.

-

Series LLC

Available in only eight states—Nevada, Delaware, Illinois, Iowa, Oklahoma, Tennessee, Texas, and Utah—the series LLC oversees a number of separate legal entities that fall under the same umbrella. The LLC designation gives each of these entities liability protection from legal actions taken against any of the other companies under the same umbrella, and that is its main function.

-

Restricted LLC

A restricted LLC is a legal invention of Nevada state. It alters language in the articles of organization to restrict the business distributions members can make until 10 years after the formation of the LLC. This provides a way for gifted revenues to remain tax-free while the company is in its startup phase.

-

Low-Profit Limited Liability Company (L3C)

An L3C or low-profit limited liability company, allows for-profit companies to designate a social mission as their primary goal. In essence, the L3C is another hybrid, combining the nonprofit business model with the flexible business structure of an LLC. L3Cs were specifically designed to make it easy for companies to attract funds from foundations, which are required by law to direct five percent of their assets to charity, either in the form of a grant or a “program-related investment” (PRI). L3Cs can receive both PRIs and funds from more traditional sources; at the same time, they can distribute profits among the members, just like in any other LLC. L3Cs are currently only recognized in eight states: Maine, Vermont, Michigan, Wyoming, Utah, Illinois, North Carolina, and Louisiana. As more foundations look to using PRIs, however, the popularity of this new hybrid will likely spread to more states. Companies interested in establishing L3Cs can also organize the L3C in one state and qualify it as a foreign entity in the state where they want to operate.

-

Anonymous LLC

In an anonymous LLC, the ownership details are not made public by the state in which the LLC is registered.

Want to register your LLC?

Each state has different rules and requirements, and not every state offers each permutation of LLC. That said, the general series of steps you need to take to create an LLC is as follows:

-

Choose an available business name.

When you create an LLC, the name must comply with the rules of the registering state’s division. The name must end with LLC and, depending on the state, cannot contain certain words, such as “bank,” “insurance,” “corporation,” or “city.” You’ll also need to make sure that the name you choose doesn’t violate any existing business trademark.

-

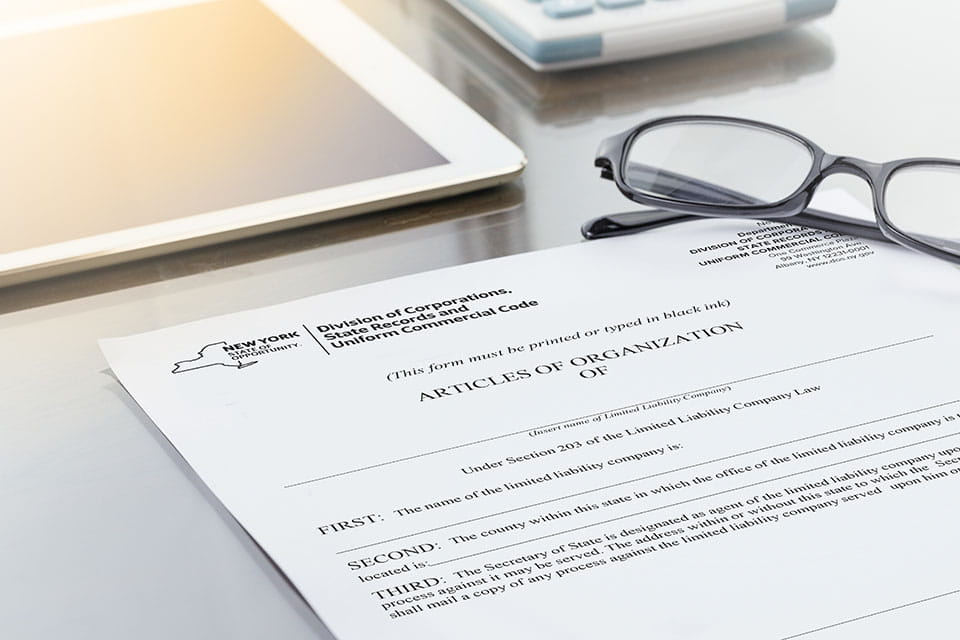

File Articles of Organization and pay a filing fee.

Sometimes called the “Certificate of Formation” or “Certificate of Organization,” the Article of Organization is the basic document you need to form the LLC. All you really need to register an LLC is the company’s name, its address, and sometimes the names of all the members.

Example of New York State Articles of Organization Form The fee varies widely from state to state, with some places allowing you to form an LLC for as little as $100. In other states, however, the fees are closer to a thousand dollars.

-

Designate a registered agent.

To start an LLC, you will also need to list the name and address of the person who will be the LLC’s registered agent, someone to whom legal documents can be delivered. This person can be a member of the LLC, but they don’t have to be. Each state has different requirements for who can be a registered agent for your LLC, and many companies offer registered agent services for a fee.

-

Create an operating agreement for your LLC.

The operating agreement does not have to be made public. However, it is the founding document for your company, the one in which all members’ rights and responsibilities are laid out. A typical operating agreement might include the following:

- The members’ percentage interests (especially if they are not all equal).

- Each member’s rights and responsibilities.

- Whether each member has voting rights over major decisions.

- How the company will allocate profits and losses.

- What will happen to their interest if a member decides to leave the LLC?

- What the policy will be regarding notes and minutes.

-

Publish a Notice of Intent

Only a handful of states require this brief notice that you intend to form an LLC. If your state is one of them, you must publish the notice of intent in a local newspaper several times over a period of weeks, then submit an “affidavit of publication” to the filing office of the LLC. Once these five steps are completed, your LLC is official. It is now up to you to obtain whatever licenses, federal documents, or zoning permits your business needs to operate legally in your state.

Want help from experts instead of creating an LLC yourself?

We offer a fast LLC creation service, including a money back guarantee and outstanding expert support.