Article Contents

The Quick Guide to Forming a Corporation (C corp)

Despite the development of options that offer more flexibility, the traditional or “C” Corporation remains one of the United States’ most popular business structures. It offers unlimited growth potential through the sale of stock, and there is also no limit on how many shareholders a C corporation can have. For a company looking to expand and eventually attract global partners and investors, it’s hard to beat the C corporation.

What is a C corp?

C corporations get their name from the section of IRS code, subchapter C, that regulates them. Until the advent of S corporations in the 1950s, they were the only incorporated business structure, and to this day people refer to them simply as “corporations.” A corporation is a legal charter granted by a state to investors who want to gather private funds for a specific purpose. In the early days of the United States, most companies received charters to perform specific public functions, like building a bridge or improving a road. The charter would last as long as it took for the work to be completed; often, it was revoked soon afterward. The corporation did not have many other rights, other than the basic right that a government would acknowledge its existence. In 1844, the British passed the Joint Stock Company Act, which created an agency, the Registrar of Joint Stock Companies, that could register new corporations via a two-step process. With this legislation, Britain effectively passed control of corporations from the government to the courts. Ten years later, in 1855, corporation owners received limited liability, protecting their personal assets from any malfeasance on the part of the corporation. It was not until 1886, however, that a landmark U.S. decision recognized corporations as “natural persons” under the law, Language in the 14th Amendment of the Constitution, designed to protect emancipated blacks in the South, was re-purposed to give corporations “equal protection” under the law. Since that decision, the Supreme Court has extended to corporations some of the rights afforded to individuals in the Bill of Rights, including the ban on warrantless search and seizure. In 2010, with Citizens United, the Court ruled that corporations have the right to spend money however they want in local, state, and federal candidate elections. This decision has resulted in giving corporations the ability to influence elections and back candidates who support more corporate-friendly rules and regulations. With that power, comes responsibility.

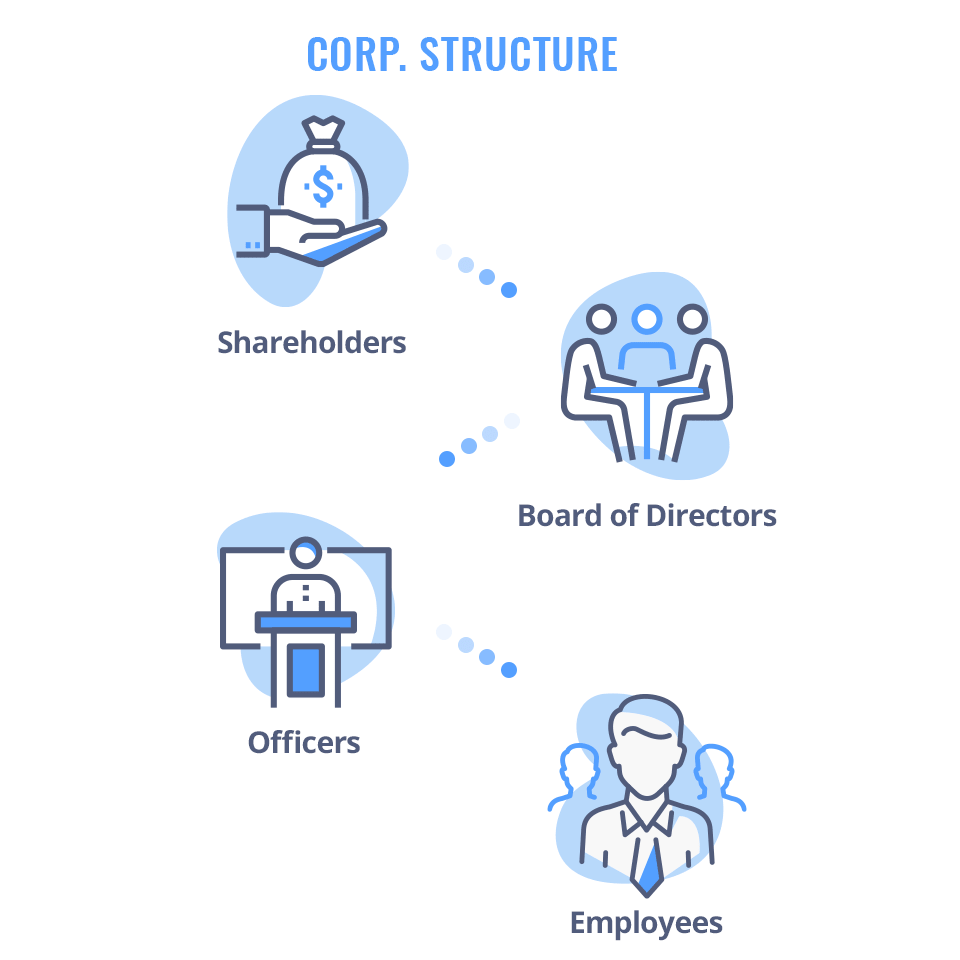

How is a C corp Structured?

Regardless of whether a C corporation is small or large, it will have the same top-down structure, though, in small companies, one person may need to play several of these roles at once:

Board of Directors

These individuals manage the corporation and are responsible for major decision-making, including the important task of setting the company’s strategic direction. They also issue stock and elect the officers.

Officers

Every corporation must have a president, treasurer, and secretary. They make the day-to-day decisions about how to run the company.

Shareholders

They own the company’s stock. They are also responsible for electing the directors, amending bylaws, the company’s articles of incorporation, and approving actions like mergers and sell-offs. Only the shareholders can vote to dissolve the corporation.

Employees

They receive a salary in exchange for working at the company. Employees may or may not also be shareholders.

How does the C corp differ from other business and corporate structures?

The C corp’s main feature is its unlimited growth potential. Unlike the S corp, which can have no more than 100 shareholders, must restrict its business to the United States, and can only issue common stock, the C corp has none of these restrictions. An owner does not need to be an American citizen, nor does the corporation need to operate in the United States. There can be unlimited shareholders. Moreover, C corporations are attractive to investors because they can issue any class of stock. The C corp is also the only business structure that is taxed as its own entity—i.e., it must file its own taxes through a designated tax form (IRS Form 1120). C corps also have their own tax rates, separate from the individual tax rate schedule. The Tax Cuts and Job Act of 2017 lowered the corporate tax rate from 35 percent to 21 percent; taking into consideration an average of the state corporate tax rate, the statutory corporate income tax rate is 25.7 percent. State corporate tax rates range from, three percent in the state of North Carolina, to 12 percent in Iowa. Some states, like Texas and Nevada, have no state corporate taxes.

S corps, LLCs, general partnerships, and sole proprietorships all have “pass-through” taxation, meaning that business owners pay what taxes they owe from company profits on their own personal 1040, and can use business losses to lower their overall tax liability. Unlike sole proprietorships and general partnerships, C corps have limited liability; the owners’ personal assets are protected in the event that someone decides to sue the company for damages. Finally, unlike LLCs, sole proprietorships, and general partnerships, C corps have a top-down corporate structure rather than a member (or partner) managed company structure. C corps must make public the results of their annual meeting, so there is a regulatory layer that member-managed companies lack.

What are the advantages of becoming a C Corp?

Owners have limited liability.

A C Corporation is a separate legal entity, and the liabilities of the company are separate from shareholders’ personal assets. Liability is “limited” because shareholders may have used personal assets as collateral on a business loan. The assets may be liable, depending on the extent the individual has invested in the company. But in most cases, personal assets cannot be touched.

The C Corporation has “perpetual existence”, independent of its owners.

Unlike general partnerships and sole proprietorships, where the business ends with the life of the proprietors, C corps live on in perpetuity—unless the shareholders vote to dissolve the company.

Corporate ownership is fluid.

To own a corporation, you must have a controlling interest in the company stock. Another way of putting this is to say that the shareholders with the most stock own the company. Most individual investors in a publicly-traded company own just a tiny fraction of the company; however, those central to the business own larger percentages and generally seek to maintain controlling interest. It is possible, however, for individuals to buy the controlling interest in a company’s stock against the will of the directors, resulting in a hostile takeover.

It is easy to attract investors.

C corps have more opportunities to raise capital than any other business structure. Although a fledgling corporation could be seen as a risk to some banks, corporations have a powerful fundraising tool at their disposal. They can raise unlimited amounts of money through the sale of common stock. Companies that wish to raise money in this way may hold an Initial Public Offering (IPO) to offer shares of their stock on the public exchange. They can issue preferred stock, which pays out dividends to the investor before common stock does. This makes C corps an attractive prospect for venture capitalists.

Incorporated businesses garner more respect.

Most of the businesses that we know and trust are C corporations. To the consumer, incorporating your business means that you anticipate growth for your company and are committed to seeing that growth come to fruition. This can give you more credibility both with customers and potential investors.

There are tax-deductible business expenses.

The term “fringe benefits” is synonymous with corporate culture, and there’s a reason for that. Expenses like a company car or annual retreat are tax deductible.

What are the disadvantages of becoming a C Corp?

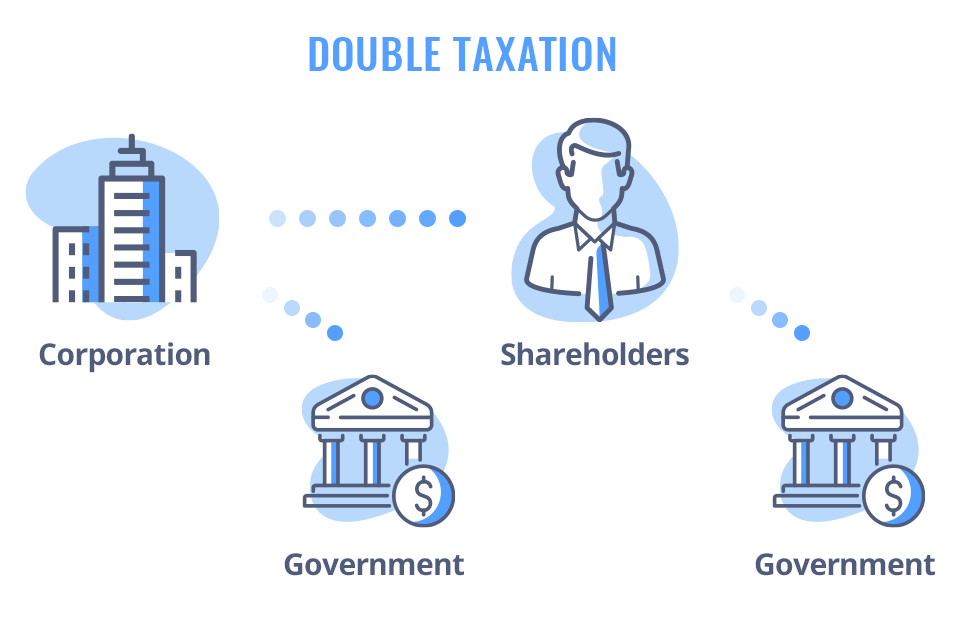

Shareholders experience double taxation on stock dividends.

Because they are legally a separate entity, C corps have two layers of taxation. First, the business itself is taxed on its profits. If the company chooses to issue some of those profits in the form of dividends, they are taxed again at the individual shareholder level. Most companies seek to avoid the worse effects of the double tax burden. They may choose to pay shareholders who are also company employees a large salary (as opposed to compensation through dividends), or they may reinvest the profits back into the business, which also serves to mitigate the tax burden.

There are a lot of rules and formalities.

C corporations are subject to an extra layer of transparency that other business structures, such as LLCs and general partnerships, do not have. They are required by law to hold an annual general meeting (AGM) for both the shareholders and the board of directors, at which, important decisions are announced and discussed. The minutes of this meeting must be made public. A C corp must elect a board of directors whose responsibility it is to draft bylaws or written protocols for how the company will function. The C corp is also required to have a corporate structure, with shareholders, a board of directors, officers, and employees. In small companies, there may not be enough individuals to fill each of these roles, so one person may wear many hats.

There is no deduction for corporate losses.

With a C corp, shareholders lose the ability to deduct corporate losses the way they can in an S corporation, allowing them to lessen the overall tax burden. That’s because the C corp is taxed as a separate entity.

Want to register your business as a C Corp?

Registering a C corp can be overwhelming because of all the requirements. Here are the steps you need to take.

-

Choose a legal name for the company.

You want to pick a unique name that will not cause trademark issues later, and one that will generate strong positive connotations for your prospective customers. The name should be able to convey the main elements of your business; the more your name communicates to the consumer, the less work you will have to do explaining the concept. The name should use real words and should strive not to limit itself by focusing on something so specific that there is no room for expansion beyond that thing.

-

Reserve the business name with the Secretary of State, if possible.

The secretary of state also keeps a record of the names that have been registered in the past, which makes it a bit easier to see if your desired name has already been chosen.

-

Draft and file the articles of incorporation with the Secretary of State.

The articles of incorporation, also sometimes known as the corporate charter, are a set of formal documents that legally document the company’s creation. In other words, they act as a charter to recognize the establishment of the company. These documents should contain important information like the corporation’s name, address, and the names and addresses of the designated registered agent, the initial board of directors, and the number and class of authorized shares. The articles of incorporation also indicate what type of corporation you are forming—whether it is a for-profit or non-profit, for instance.

Example of New York State Certificate of Incorporation. -

Identify the initial shareholders and issue stock certificates to them.

You don’t need to issue all the stock shares you authorize, but in order to avoid incurring additional filing fees down the line, you must be sure to authorize enough shares to cover a start up’s short-term planned issuances. A startup should issue approximately 60 percent of its stock certificates at the incorporation stage and create a reserved option pool for the remainder.

-

Apply for any pertinent business licenses.

Apply for any pertinent business licenses and industry-specific certificates.

-

Get an Employer Identification Number (EIN) from the IRS.

The EIN is like a social security number for your business and is typically required when you apply for a bank account in the company name. You will need the EIN to file taxes and fill out W9 forms. It will also help you to establish credit in the company’s name and make it possible to take out business loans.

-

Apply for ID numbers required by the local and state government agencies.

Your business will most likely need to pay employees’ unemployment, disabilities, and other payroll taxes. Your C corporation will need tax ID numbers for each employee account in addition to establishing its own EIN.